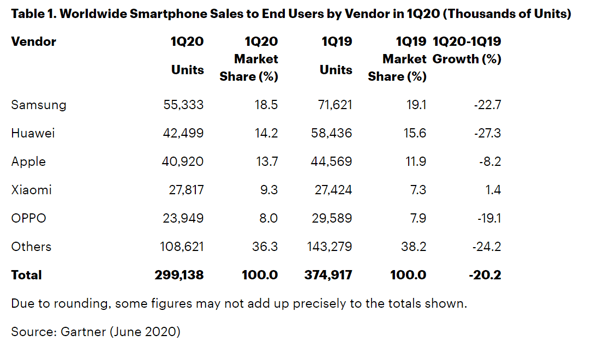

Global shipments and sales of smartphones have plummeted by 20 percent in the first quarter of 2020 due to Covid-19, but will this have any impact on what we have to pay for devices?

Early indications suggest smartphone prices might soften in the second half of 2020, especially if the global economy does not rebound and consumer confidence remains low.

The Covid-19 pandemic has delivered a double whammy to the smartphone industry - hitting first the supply chain and then consumer demand. What started primarily as a supply-side problem out of China, grew into a global economic crisis with retail outlets across the planet closing and consumers worldwide in lock-down causing a massive demand-side impact.

“The coronavirus pandemic has caused the global smartphone market to experience its worst decline ever."

Anshul Gupta senior research analyst, Gartner

All smartphone vendors, except Xiaomi, have taken a hit

All of the top five smartphone vendors recorded hefty declines in the first quarter of 2020, except for Xiaomi. It managed to avoid the worst of the lock-down impact due to a strong online sales presence particularly for its entry-level and mid-range Redmi devices.

What's happening with Samsung

Samsung smartphone sales collapsed by 22.7% in the first quarter of 2020, but the Korean company still maintained the No. 1 spot with 18.5% market share. When the pandemic hit, Samsung had more inventory in the channel in preparation for new smartphone launches. It also benefited from its manufacturing facilities being outside China, based in Vietnam and Korea. However, an inefficient online channel combined with the lock-down led to much weaker sales.

What's happening with Apple

Apple had the least decline in sales of the top five manufacturers with a decline of 8.2% - though this does translate into 41 million units! Apple had been experiencing a strong start to the year due to the unexpected popularity of the iPhone 11, according to Annette Zimmermann, research vice president at Gartner.

"If COVID-19 did not happen, Apple would have likely seen its iPhone sales reach record levels in the quarter. Apple’s ability to serve clients via its online stores and its production returning to near normal levels at the end of March helped recover some of the early positive momentum.”

What's happening with Huawei and Oppo

Huawei fared the worst of the top five global smartphone vendors. Sales fell by 27.3% year over year. This was the brand's first ever decline in smartphone sales, however Huawei still held onto the No. 2 position with 14.2% market share.

Oppo’s smartphone sales fell 19.1% in the first quarter of 2020. Oppo’s offline distribution model ,which is usually considered one of its strengths, caused the manufacturer to suffer as the work-from-home trend forced consumers and businesses to purchase products online.

Will we pay less for smartphones in the second half of 2020?

Apple seems to be reviewing its pricing strategy to compete for a share of the mid-market. This move started before the pandemic with the release of the iPhone SE in February. Meanwhile Samsung had already begun discounting its flagship Galaxy S20 series before Covid-19 after less than enthusiastic sales.

The impact of Covid-19 is likely to consolidate plans for Apple to deliver its new iPhone 12 across a range of price points, starting at a lower price than we have seen in the past. Meanwhile discounting of older model phones across all manufacturers is also expected as the year progresses.

Amazon Great Indian Festival 2019

Amazon Great Indian Festival 2019

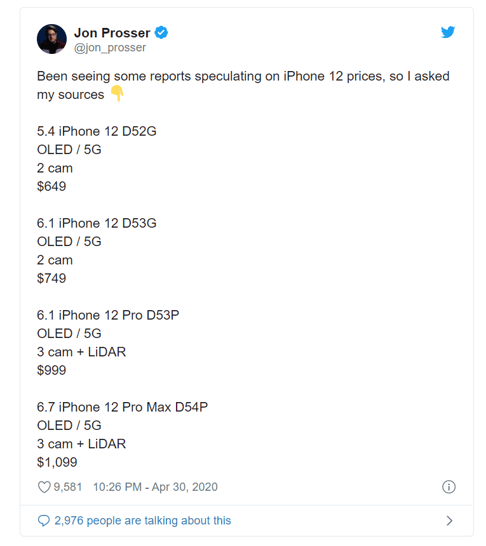

Apple iPhone 12 pricing rumoured to be under A$1,000

Apple is due to launch the iPhone 12 in September. Rumours abound but it is universally believed there will be at least four new versions of the iPhone 12 and it will be the first 5G-compatible Apple smartphone, will have an OLED screen, and most likely boast a LiDAR scanner.

Apple has never sold a new iPhone with an OLED display for under US$999, but the iPhone 12 line-up is expected to include a wider range of models including a smaller 5.4" model, which pundits predict will be US$649.

Industry insider, Jon Prosser of Front Page Tech, has predicted that price will be a major feature of the iPhone 12. Analysts are listening to Prosser after he accurately predicted the pricing of the SE20 launched in February for A$749.

Prosser has claimed US$649 for the entry level iPhone 12, which will be a smaller handset with a dual camera set up. This would make it under A$1,000 and less than the cost of the current iPhone 11 which starts at A$1,199.

Samsung S20 already being discounted

Meanwhile Samsung was already discounting its 2020 flagship device, the Galaxy s20 series, before the pandemic. In Australia the Galaxy S20 was discounted from Day 1. From launch, Telstra ran a limited-time discount offer of $150 off the 128GB S20 or S20+ 5G devices paired with any Telstra month-to-month mobile plan. There was also an offer of 80,000 Telstra Plus points, and a free pair of Galaxy Buds+ for pre-ordering.

The S20 range has not enjoyed an auspicious start, and analysts are questioning whether this is altogether due to coronavirus. Instead they are pointing to issues with new camera features and a higher price tag.

According to the Korea Herald, the new flagship line had a disastrous launch in Korea, with sales down 50% compared to the launch for the Galaxy S10 line.

It is reasonable to expect continued discounting of this line especially towards the end of the year.

Price cuts also predicted on older models

Frank Gillett, an analyst at research firm Forrester, is also predicting price cuts on older smartphone models. If the demand continues to be impacted as the year progresses, new pricing strategies could be put into place, he says.

"What you might also see are some creative pricing models to make it feel more affordable and responsive to people's situations. Perhaps there will be a temporary promotion to help people out at a lower price if they can show an unemployment cheque or an emergency services ID."

About MobileCorp

MobileCorp is an Australian communications technology company providing Managed Mobility Services, Mobile Device Management, Complex Data and IP Networks, and Unified Communication solutions. We have a proven track record providing solution architecture, build, deployment, and managed services for Australian enterprise and business.

MobileCorp Michelle Lewis 15 Jun 2020

Related Posts

Popular Tags

- Mobility (80)

- Mobile Devices (79)

- Telstra (65)

- 5G (60)

- MobileCorp Managed Services (55)

- Mobile Network (34)

- Networks (34)

- Cradlepoint (31)

- Apple (29)

- MobileCorp (29)

- iPhone (25)

- Remote Working (23)

- Covid-19 (16)

- Network (16)

- Mobile Security (15)

- Wireless WAN (15)

- Cyber Security (14)

- UEM (14)

- MDM (11)

- Mobile Expense Management (10)

- Mobile Device Management (9)

- TEMs (9)

- Mobile Device Lifecycle (8)

- Cloud (7)

- Unified Comms (7)

- Unified Communications (7)

- Wandera (7)

- Android (6)

- Sustainability (6)

- Data Networks (5)

- Network Security (5)

- Samsung (5)

- Security (5)

- Digital Experience (4)

- IOT (4)

- Microsoft Intune (4)

- IT Services (3)

- Microsoft (3)

- Data (2)

- Government (2)

- Microsoft 365 & Teams (2)

- Retail (2)

- nbn (2)

- webinar (2)

- Blog (1)

- EMM (1)

- Emerging Technologies (1)

- Hosted Telephony (1)

- Managed Desktops (1)

- SD-WAN (1)

- Starlink (1)

- Telstra Services (1)

- video (1)