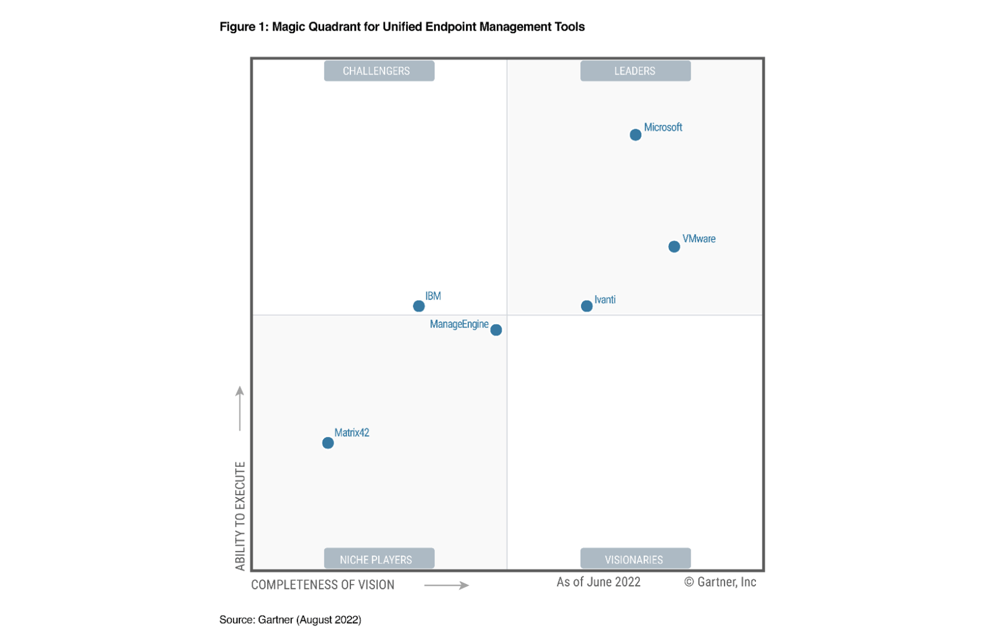

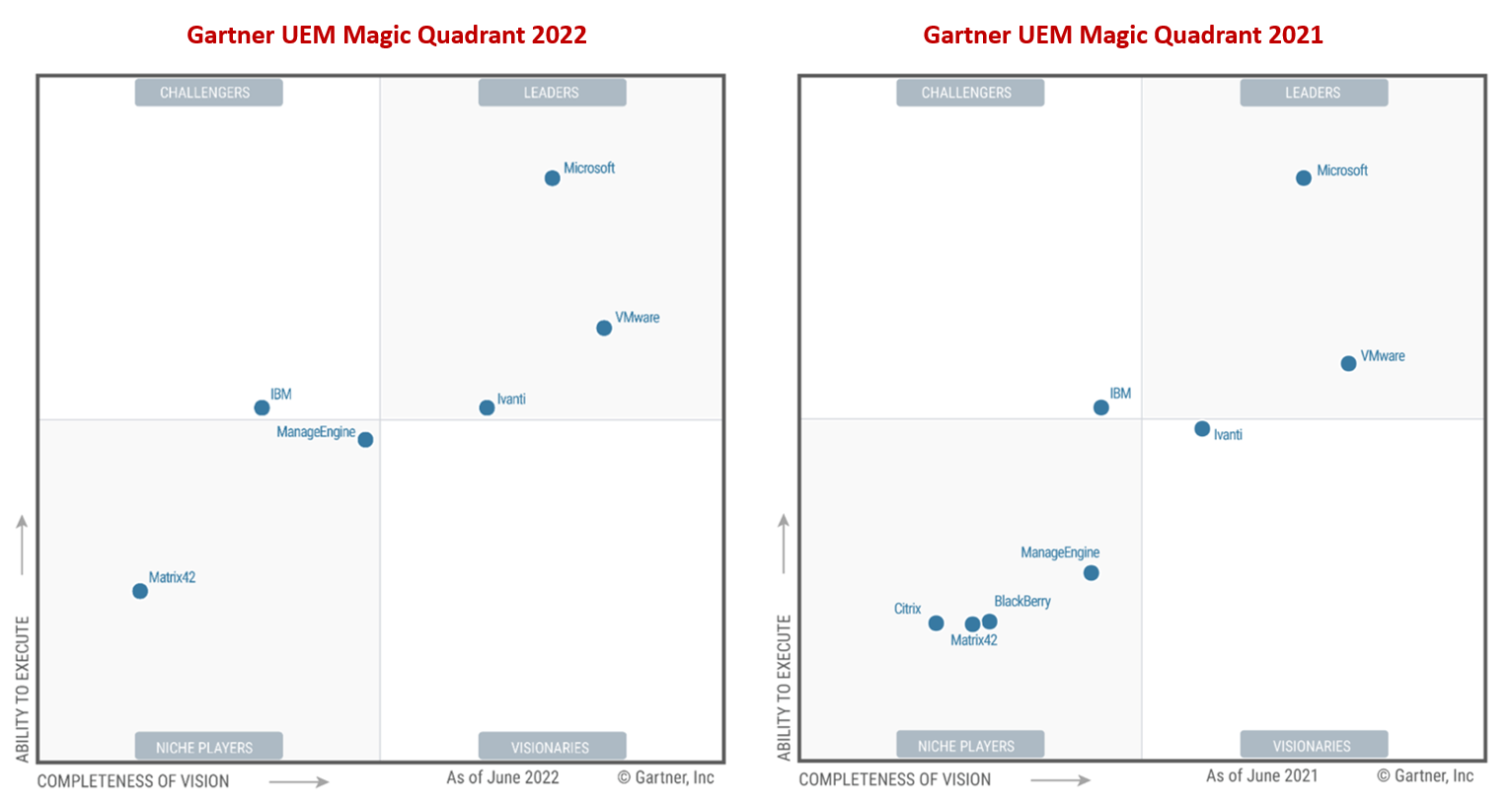

Only three vendors have been named as 'leaders' in the Gartner UEM Magic Quadrant for 2022, and Microsoft is once again in a league of its own.

In 2019 there were 11 vendors in the UEM Magic Quadrant, with six featuring in the Leader quadrant.

Just three years later in 2022, the total number of vendors is just six, with three Leaders.

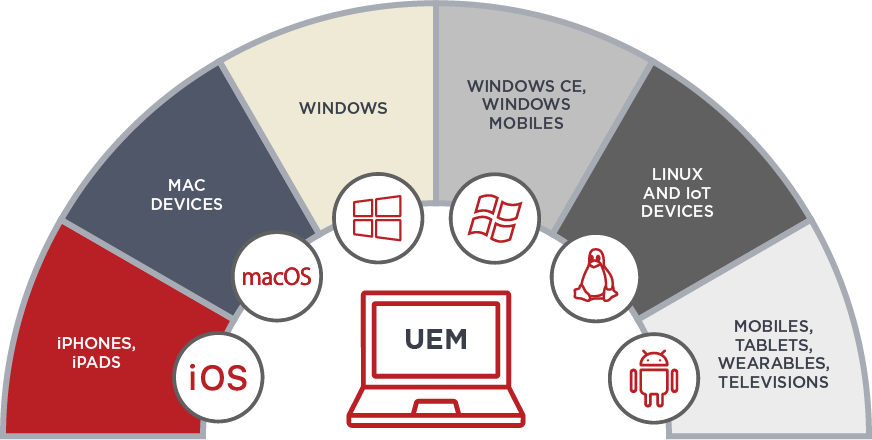

The loss of vendor numbers reflects Gartner's redefinition of the UEM market from a focus on mobile devices to a focus on the broader management of both mobile devices and PCs – especially their ability to “remotely deploy and provision devices, applications and updates and security patches.”

This shift in definition was signalled by Gartner prior to the pandemic and was proven to be a correct realignment as the category expanded and was accelerated by the dramatic move to remote work.

Microsoft way out in front, VMware still chasing hard, Ivanti big mover

Microsoft, for the second year in a row is well ahead of the competition, although VMware has closed the gap somewhat over the past 12 months.

Microsoft retains its clear Leadership for Ability to Execute, although VMware has improved its position from 2021 and continues to lead on the other axis, Completeness of Vision.

Ivanti has been the big mover over the past four years and moves into the Leader quadrant for the first time in 2022 - albeit only just scraping over the line.

Microsoft leads because 'its Microsoft'

Strengths

-

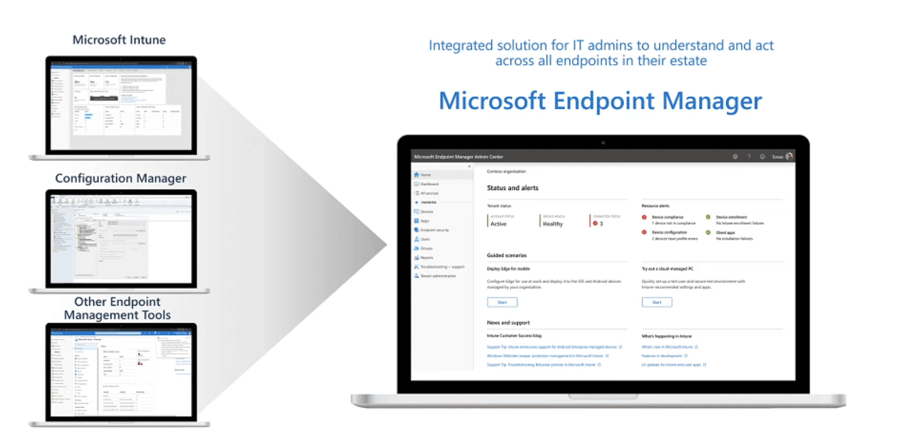

Microsoft-native: Deep platform integration with Azure AD, Defender for Endpoint and Microsoft 365 suites of products offers improved security and IT administrator experience. Evidence of improved stability and performance achieved by replacing third-party plug-ins with native solutions cannot be ignored.

-

Cloud-connected: Improvements in hybrid Azure AD join and Tenant Attach have accelerated the adoption of cloud management of devices via co-management and modern management. The ability to migrate when ready is cited during customer reviews on Gartner’s Peer Insights platform, in feedback collected during client interactions and in social media discussions. This is especially true of organizations that cannot or are not yet ready to exclusively embrace modern management.

-

Product strategy: With the growth of Microsoft 365, Endpoint Manager continues to dominate UEM market share. New features and fixes are prioritized based on customer demand. Sustaining prior momentum, Endpoint Manager branding has become commonplace among clients, and Gartner observes that it is mentioned widely and favorably in social media.

Cautions

-

Reporting: Dashboard and reporting capabilities are basic, with limited prebuilt reports available compared with competing products. Many clients report that the creation of custom reports via Microsoft Graph integration is labor-intensive and requires specialized skills to be effective.

-

Endpoint diversity: Endpoint Manager lacks comparable capabilities to manage Chrome OS and Linux endpoints. The product also lacks endpoint diversity to support specialized vertical-specific use cases involving wearables, rugged frontline devices and IoT.

-

Complexity: Despite increased investment in Microsoft Learn courses, quick start guides, how-to videos and more prescriptive guidance, feedback collected during client interactions reveals that they still struggle to keep pace with changes. Clients also underestimate the overhead required to operate Configuration Manager and integrate it with Intune, Azure AD and on-premises AD. Those that migrated from other client management tools (CMTs) are also frustrated with the lack of third-party application patching capabilities and the requirement to purchase a third-party solution for this capability.

VMware retains the Visionary crown, and closes the gap

Strengths

-

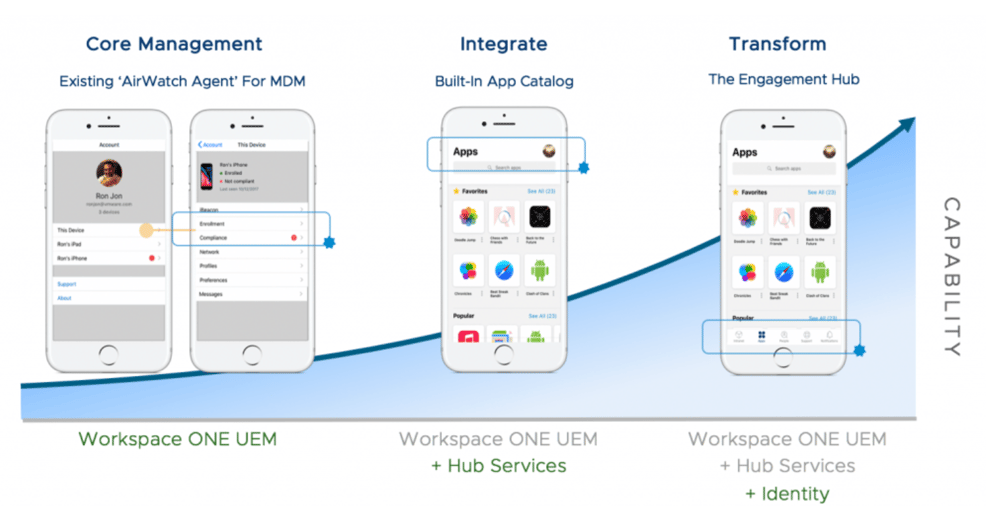

Product strategy: VMware is the only vendor in this research with a complete package that includes device management, single sign-on, remote support, remote access, endpoint security, analytics, automation and virtualization. VMware also added SaaS management capabilities through its partnership with BetterCloud.

-

Ease of use: Workspace ONE provides templates, baseline configurations and wizards that help reduce IT administrator overhead. It also combines traditional and modern management capabilities instead of integrating otherwise disparate tools. The Digital Workspace Tech Zone website resource enables IT administrators to keep pace with changes and updates.

-

Intelligence and automation: Workspace ONE includes Workspace ONE Freestyle Orchestrator, a low-code automation workflow designer that can take action on devices and applications based on triggers from UEM events and data. Workspace ONE Essentials editions include Workspace ONE Intelligence for insights and reporting and rule-based automation. The Enterprise Edition adds use-case focused solutions to measure and improve DEX, Risk Analytics for continuous verification based on machine learning, and risk scores from device context and user behavior.

Cautions

-

Pricing: Clients get the most value from Workspace ONE through advanced features, such as DEX management, risk-based conditional access for zero trust and use-case focused solutions for automation and intelligence. These are only available with the Advanced or Enterprise license tiers, which are priced among the highest of the products evaluated in this research.

-

Microsoft 365: VMware customers committed to Microsoft 365 continue to struggle to justify investment in a tool that is viewed as overlapping with capabilities that they may already be entitled to under their existing Microsoft 365 licensing.

-

Feature parity: Many of the advanced Workspace ONE capabilities require the use of its SaaS offering. These include reporting and dashboards with historical data, automation with third-party integrations through custom connectors, Risk Analytics, Digital Employee Experience Management and Workspace ONE Trust Network.

Ivanti moves into Leader quadrant for first time

Strengths

-

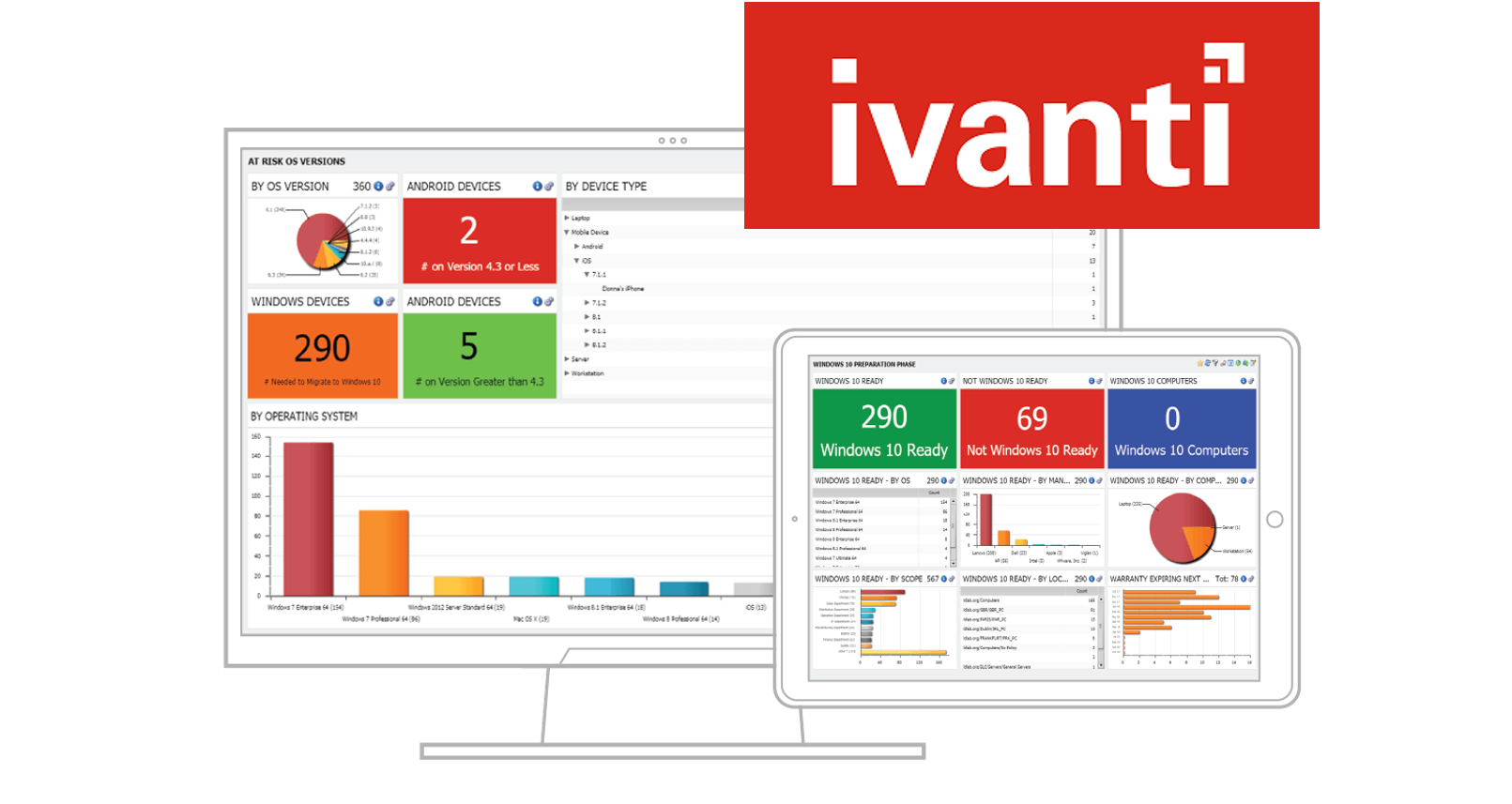

Intelligence and automation: Ivanti Neurons for Unified Endpoint Management is the only solution in this research that provides active and passive discovery of all devices on the network using multiple advanced techniques to uncover and inventory unmanaged devices. It also applies machine learning (ML) to the collected data and produces actionable insights that can inform or be used to automate the remediation of anomalies.

-

Broad capabilities: In addition to the OS management capabilities required for inclusion in this Magic Quadrant, Ivanti offers management of many Linux distributions and server OSs, OEMConfig and Android Open Source Project (AOSP) devices, and wearables. It also can manage devices via SNMP. Ivanti includes OS and application patching capabilities, as well as integrations with its own and third-party IT asset and service management (ITAM/ITSM) tools. Ivanti’s acquisition of RiskSense in August 2021 enhances all of its patch management capabilities by adding a contextual assessment of risk, rather than depending on CVE or CVSS. This is available with an add-on license.

-

Vertical market solutions: Ivanti has rich solutions aligned to the healthcare, education, logistics, public-sector and retail markets. These offerings have the potential to replace individual products that typically don’t work well together, and also can help clients achieve the benefits of efficiency and consolidated management offered by UEM tools, within their vertical market context.

Cautions

-

Licensing model: As Ivanti continues to expand its offerings, migrate to the cloud and add Ivanti Neurons capabilities to each product, it’s becoming more challenging to navigate the website, bundling and pricing. Gartner clients often cite confusion with understanding what specific capabilities are included with each product or hosting option, or if additional licensing is required.

-

IT administrator experience: Although Ivanti continues to make progress on integrating acquired products with each release, IT administrators will likely still find themselves using several different, but similarly designed, consoles to perform management actions.

-

Feature parity: Some features and extended capabilities of the product are not available on-premises, including the advanced discovery, intelligence and automation from Ivanti Neurons. The SaaS offerings are updated more frequently and receive updates faster than their on-premises counterparts.

IBM, ManageEngine and Matrix 42 also on the board

These three vendors each appeared in the previous 2021 quadrant and retained representation in 2022.

Of these, ManageEngine made the sharpest move improving its ability to execute significantly to be now sitting just outside the Leader quadrant in the Niche Players square.

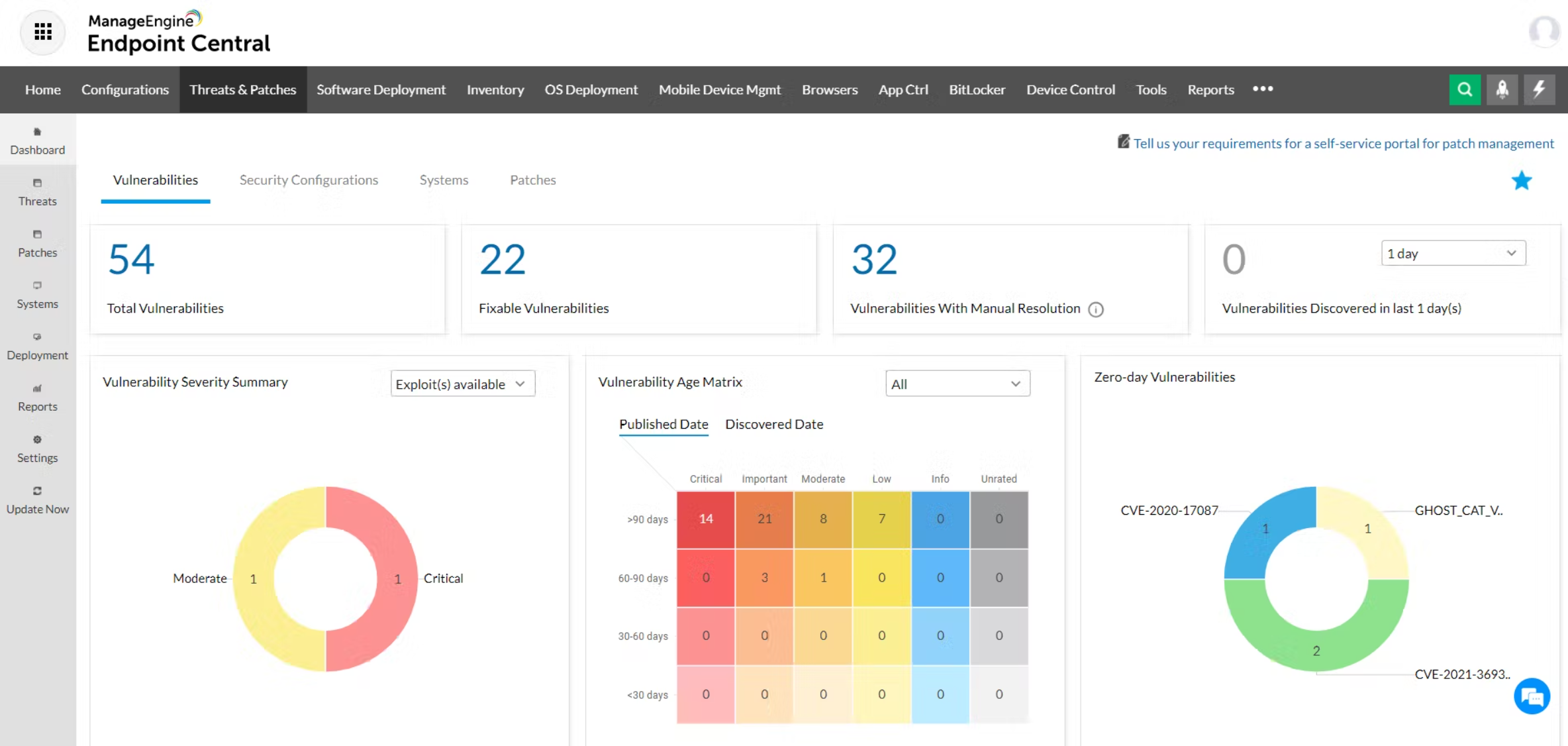

Gartner noted that ManageEngine's newly rebranded Endpoint Central product continues to expand its broad management capabilities. ManageEngine continues to invest in endpoint analytics, automation and enhanced capabilities for MSPs, as well as broadening its purview into endpoint security, remote access and zero-trust capabilities. ManageEngine's operations are geographically diversified and its clients tend to be MSEs.

Both IBM and Matrix 42 did not improve their positioning over the previous year sitting in Challenger and Niche Player quadrants respectively.

Other Vendor Ins and Outs

No vendors were added to the UEM Magic Quadrant in 2022.

Two vendors were dropped

Honourable Mentions

These vendors did not meet one or more of Gartner's eligibility criteria but were noted for their viability for clients contingent on their requirements.

What is UEM according to Gartner?

-

Provide a user-centric view of devices across device platforms.

-

Offer agent and/or agentless management through native Windows 10, macOS and Chrome OS controls.

-

Offer agentless management through native Apple iOS/iPad OS and Google Android controls.

-

Aggregate telemetry and signals from identities, apps, connectivity and devices to inform policy and related actions.

-

Aggregate and analyse technology performance and employee experience data.

-

Integrate with identity, security and remote access tools to support zero-trust access and contextual authentication, vulnerability, policy, and configuration and data management.

-

Manage nontraditional devices, including Internet of Things (IoT) devices, wearables and rugged handhelds.

Gartner UEM Magic Quadrant eligibility criteria

Gartner currently tracks more than 30 vendors in the endpoint management space. The exclusion of a vendor, says Gartner, does not mean that the vendor and its products lack viability. It simply means it failed to meet the criteria and given that one criteria is having 10 million devices under management, that effectively knocked out some smaller regional or niche players.

-

A generally available, single license product that demonstrates:

-

Agentless management of Apple iOS and macOS, Google Android, and Windows 10, which includes:

-

-

-

Agent-based management or prebuilt connector for CMT integration

-

Direct integration with the Microsoft Intune Graph API for app and data protection

-

Location-agnostic endpoint management (not dependent on LAN/VPN)

-

-

Evidence that the UEM product has at least 10 million devices under management, excluding managed devices entitled under trial, freemium or other no-cost use arrangements

-

UEM offering as turnkey SaaS (UEM vendor hosted and operated, not IaaS)

-

Rank among the top organizations in the market momentum index defined by Gartner for this Magic Quadrant. Data inputs used to calculate UEM platform market momentum include a balanced set of measures, such as:

-

Gartner customer search, inquiry volume and trend data

-

Volume of job listings specifying experience with the UEM platform as a job requirement on TalentNeuron and on a range of employment websites in the U.S., Europe and China

-

Frequency of mentions as a competitor to other UEM platform vendors within reviews on Gartner’s Peer Insights forum between April 2021 and March 2022

-

MobileCorp offers Australian enterprises its UEM managed service

MobileCorp provides management of all leading UEM platforms including Microsoft and VMWare, as well as Jamf for Apple-centric fleets.

From building a UEM instance, through testing and deployment, to ongoing management and service desk, MobileCorp has accredited highly skilled UEM engineers to deliver your UEM environment.

Our managed service includes:

- audit and remediation of existing instances

- design and build of new instances, configuration of profiles

- deployment of environment, enrolling and deploying bulk devices

- security management including device wipe, kiosk mode, profile sync

- remote application management

- proactive monitoring and technical support service desk

- data and asset management and reporting

About MobileCorp

MobileCorp is a Sydney-based communications technology company. We support companies by providing managed mobility and ICT services including mobile device security, mobile device management, expense management and managed connectivity solutions.

UEM Michelle Lewis 20 Sep 2022

Related Posts

Popular Tags

- Mobility (80)

- Mobile Devices (79)

- Telstra (65)

- 5G (60)

- MobileCorp Managed Services (55)

- Mobile Network (34)

- Networks (34)

- Cradlepoint (31)

- Apple (29)

- MobileCorp (29)

- iPhone (25)

- Remote Working (23)

- Covid-19 (16)

- Network (16)

- Mobile Security (15)

- Wireless WAN (15)

- Cyber Security (14)

- UEM (14)

- MDM (11)

- Mobile Expense Management (10)

- Mobile Device Management (9)

- TEMs (9)

- Mobile Device Lifecycle (8)

- Cloud (7)

- Unified Comms (7)

- Unified Communications (7)

- Wandera (7)

- Android (6)

- Sustainability (6)

- Data Networks (5)

- Network Security (5)

- Samsung (5)

- Security (5)

- Digital Experience (4)

- IOT (4)

- Microsoft Intune (4)

- IT Services (3)

- Microsoft (3)

- Data (2)

- Government (2)

- Microsoft 365 & Teams (2)

- Retail (2)

- nbn (2)

- webinar (2)

- Blog (1)

- EMM (1)

- Emerging Technologies (1)

- Hosted Telephony (1)

- Managed Desktops (1)

- SD-WAN (1)

- Starlink (1)

- Telstra Services (1)

- video (1)

-3.png?width=768&name=MobileCorp%20logo%20(cotiol)-3.png)